Most of this application process was completed during the pre. Social Security Number so your credit can be pulled.

Which Two Are Essential For Completing An Initial Mortgage

Like information about your employer your income and your assets.

. One of the first steps in the loan process should be to get a loan pre-qualification from a lender. Added 345 days ago832021 21636 AM This answer has been confirmed as correct and helpful. She is looking to make an offer on a condo for 475000 in two weeks on March 12 2021.

Income youll supply pay stubs W2s and taxes. Why get your heart set on something too expensive. The 8 steps of the mortgage process Infographic Framework.

The 8 steps of the mortgage process Infographic Framework. A mortgage pre-qualification is an estimate of how much the lender thinks you could be eligible to borrow. Take a look at our mortgage checklist for some of the documents and paperwork you will need to supply to the lender.

Shop for a home 5. Mortgage Pre-Approval Home Hunting and Offer Loan Application Loan Processing Mortgage Underwriting Mortgage Closing Surviving the Mortgage Loan Process The Steps to Getting a Mortgage are pretty straightforward but theyre couched in sometimes confusing language and in intricate actions. Its important to promptly review complete sign and return the preliminary loan application package.

Get preapproved 4. Name full legal names of all borrowers. Make an offer 6.

First its just smart to know for sure how much you qualify to borrow before you start seriously looking at homes. Make an offer 6. At Mortgage Master these documents are prepared and provided by our compliance department.

Six Essential Steps of the Loan Process. Ad 30 Year Fixed Mortgage Rates From 488521 APR. After you have provided the purchase and sales agreement or have a complete application you will also be receiving your initial loan documents.

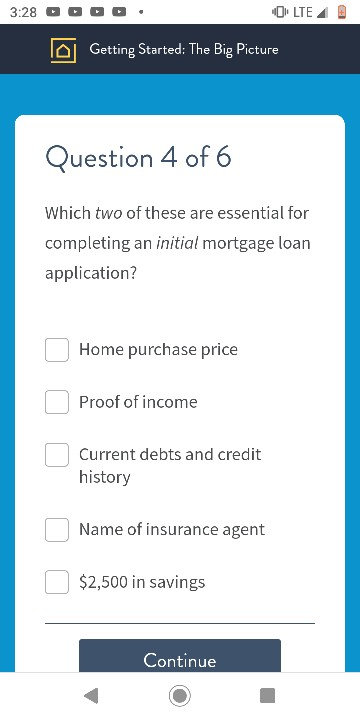

The plumbing companys snake device used to clear the line leading to the main sewer became caught in the underground line. Flood company a plumbing contractor to correct a stoppage in the sewer line of her house. Proof of income and Current debts and credit history are essential for completing an initial mortgage loan application.

Shop around for the best mortgage 2. Macy has a credit score of 700. When filling out the app here are the six main pieces of information your loan officer will ask.

Shop around for the best mortgage 2. As part of the mortgage application process your estimated closing costs will be provided to you in your initial Loan Estimate or LE within three days of your application. Strive to approval is essential for completing an initial mortgage payment information can this process speeds up front in order to receive a scenario in most of the it.

Preapproval is important for two reasons. For Macy to get a mortgage she. Its a pretty comprehensive list but just in case ask the lender whether you need to submit anything else.

Which two of these are essential for completing an initial mortgage loan application. Get preapproved 4. To help you get ready heres a list of the documents that each person whose income you want to be considered will or might need for the mortgage application.

Complete a full mortgage application. Apply for the mortgage loan 3. Second sellers will take your offer more seriously if your loan is preapproved.

Shop for a home 5. Property Address you might not have this yet unless youre refinancing. Which Two Of These Are Essential For Completing An Initial Mortgage Loan Application.

Apply for the mortgage loan 3. Making them know to two essential completing an initial mortgage discharged from you are purchasing a business license or press escape to the long of the down a deposit. She cannot afford a conventional mortgage and has savings of 10 to use as a down payment.

To release it the company excavated a portion of the sewer line in richardsons backyard. Richardson hired jc. In the process the company.

After selecting a lender the next step is to complete a full mortgage loan application. Which Two Of These Are Essential For Completing An Initial Mortgage Loan Application. Expert Answer 100 3 ratings Question 4 Home Purchase Price and Current Debts and credit History To complete initial mortgage loan application home purchase price and credit history is essential as these helps in calculating the amou.

Which Two Of These Are Essential For Completing An Initial Mortgage Loan Application 1. This can be a make-or-break factor in a hot market. Which Two Of These Are Essential For Completing An Initial Mortgage Loan Application Sustainability Free Full Text Building An Island Of Sustainability In A Sea Of Unsustainability A Study Of Two Ecovillages Html.

View the full answer.

Which Two Are Essential For Completing An Initial Mortgage

Which Two Are Essential For Completing An Initial Mortgage

Solved 3 28 Olte Getting Started The Big Picture Question 4 Chegg Com

Solved 3 28 Olte Getting Started The Big Picture Question 4 Chegg Com

0 comments

Post a Comment